Analytics & Info-graphs

Insight 1: One BC Sakhi (BC) deployed at one Gram Panchayat (GP) and GPs in UP are relatively smaller in size compared to other States e.g. Bihar, West Bengal, Jharkhand & Odisha etc. Estimated ave. banking customer in one GP could be in the range of 500 to 1000.

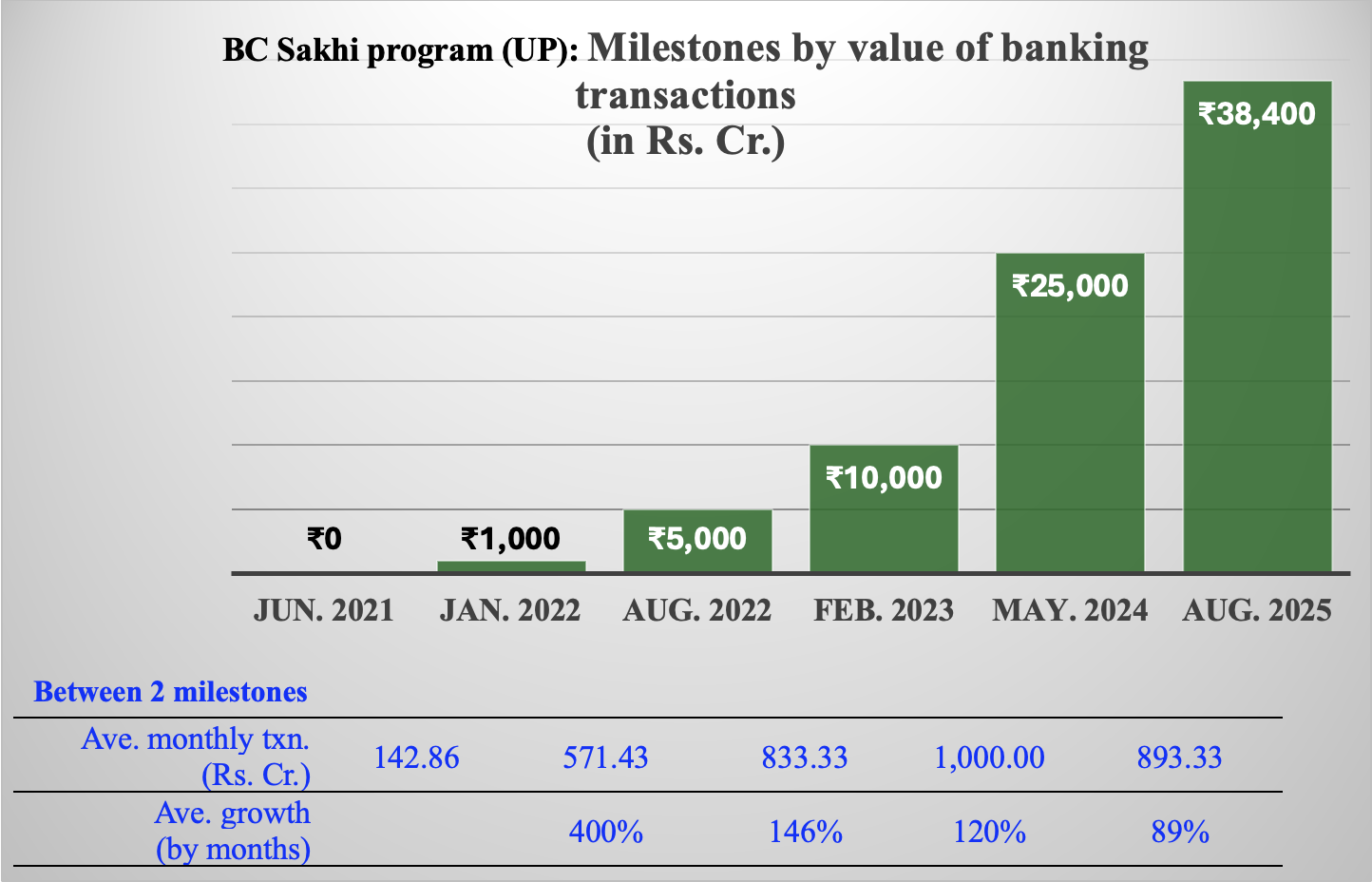

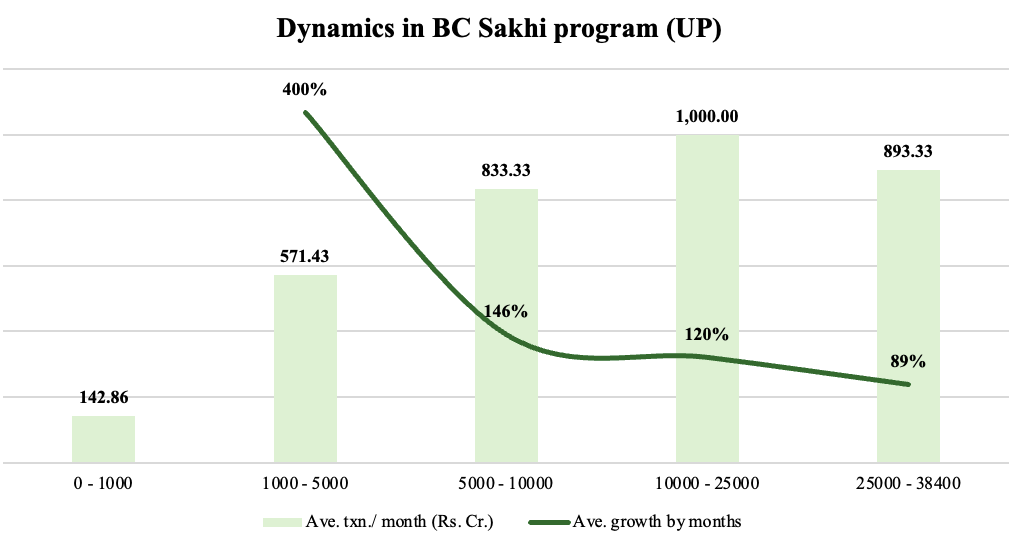

Milestones by value of banking transaction in BC Sakhi program Uttar Pradesh (UP) shows stunning trend. Breaking down the trend suggests that the growth is not a short-burst spur, rather, shows a sustained demand for financial services in villages.

Insight 2: Sharp initial growth (4-times in a space of 7 months); however, sustained high growth through last 3-4 years demonstrate high demand for banking services in rural UP, especially amongst the poor and women. Lowering trend in growth may be attributed to saturating the limited segment of banking customers in a GP and stabilizing the crave for cash routinely.

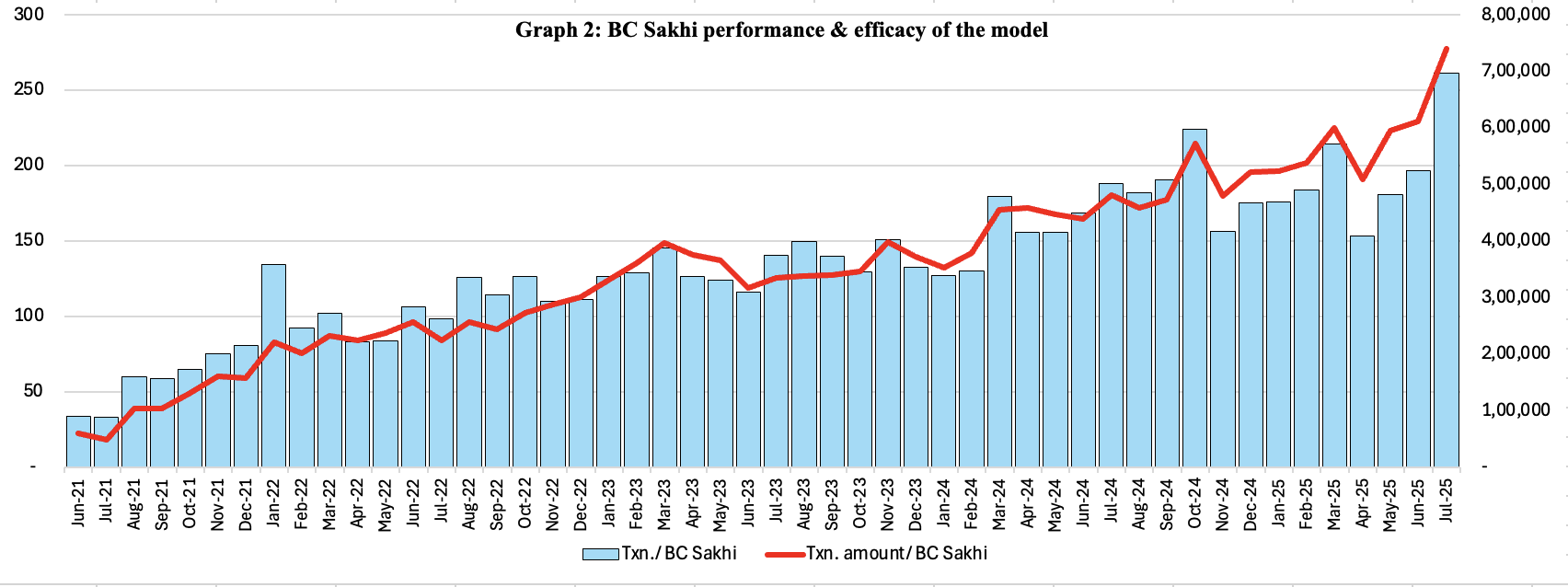

Insight 3: The hidden angle_ a reflection on BC Sakhi performances establishes the robust theory of the model and efficacy of the concept. UPSRLM's lack of monitoring of program operations, dynamics thereof and overall performance/ non-performances, stunning patterns of BC Sakhi performances surface.

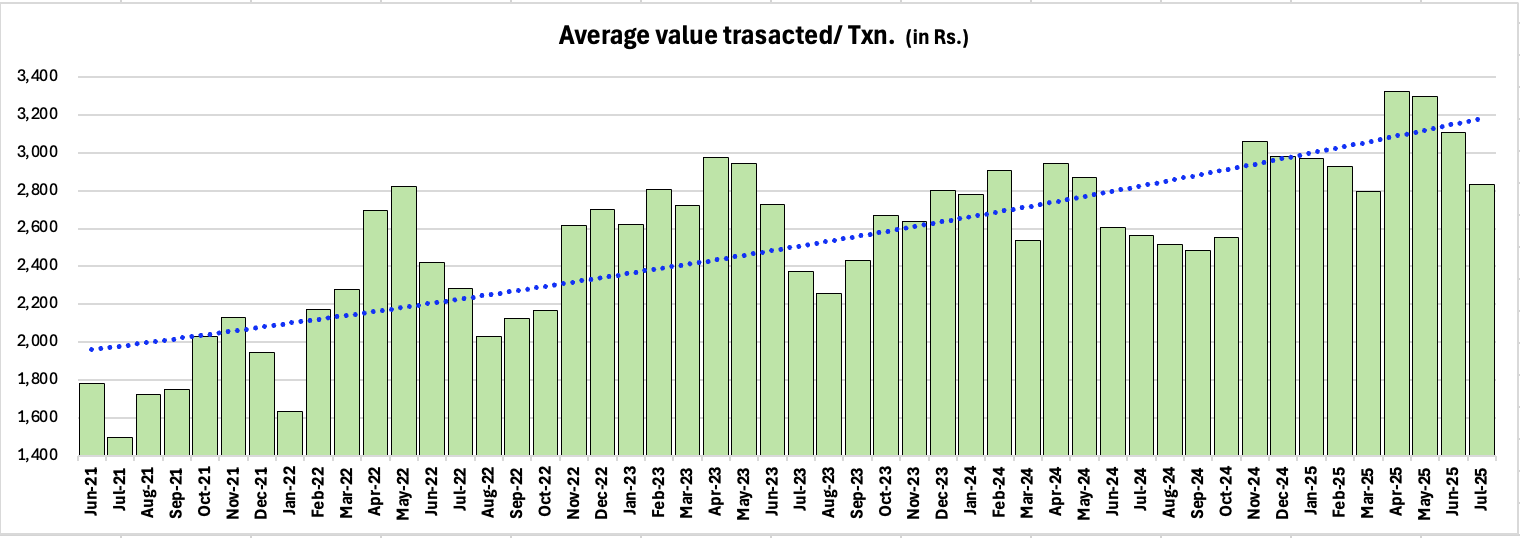

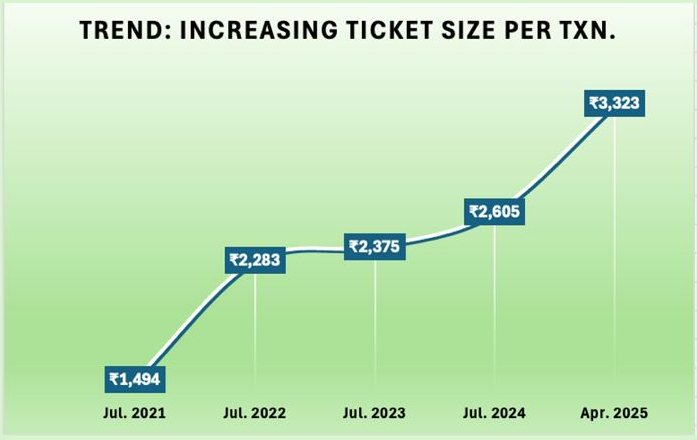

Technically, the two key performance-inputs are (a) no. of txn. each BC is undertaking progressively, and (b) consequential value or txn. ticket size.

Technically, the two key performance-inputs are (a) no. of txn. each BC is undertaking progressively, and (b) consequential value or txn. ticket size. While the first is about operational effectiveness and efficiency of the BC Sakhis, the second is about customer response because of reliability of & trust over BC services (Ref. Graph below).

Insight 4: A month-to-month trend and pattern of ticket size per transaction has been shown here. It is observed that that dynamism in varying transaction-values is largely impacted by _ (a) festivals, (b) disbursement of large DBTs such as Kisan Samman and (c) FY-milestones.

Increasing transaction-value for the poor and underbanked customers throw a host of crucial insights: 1st, BC Sakhis have emerged as a stable provider of Banking services, and 2nd since these transactions are conducted in cash and amongst the most marginalized such as the poor and women, BC Sakhis enjoy trust of these customers.

Insight 5: The Graph shows a hidden phenomenon that has been happening silently. An average BC Sakhis' performance in terms of value of BC transaction has been rising dramatically.

At the start of the program (June 2021), an average BC Sakhi would render banking services worth Rs. 1,500/- per transaction reached at a high of 3,400/-on April 2025.

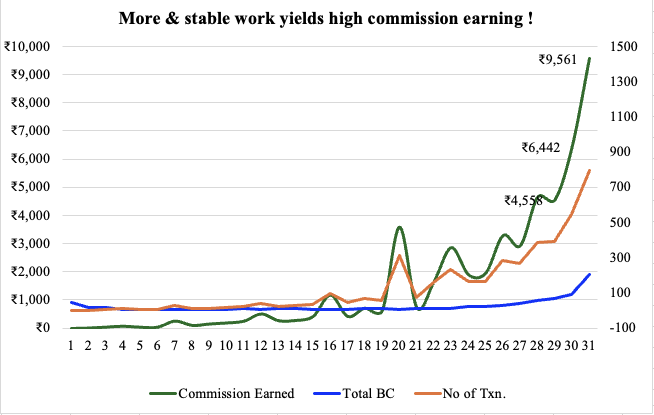

Insight 6: The graph shows in X-axis the no. of working days for BC Sakhis and the primary & secondary Y-axes show commissioner earned and transactions conducted, respectively. The learning that consistently been emanating is the BC Sakhis that are consistent in provision of services, are valued better by customers. Here the BCs that have worked for 29 days, have earned @Rs. 4.5 thousand at an average, while the once that have worked just 2 more days (31-days), have earned almost double commission!

Working all days with table working hours and ensure consistent service provision does the trick. Not easy, this requires steady flow of liquidity and zero down-time technology support.